Union Deductions Examples . it ensures that no employee can opt out of paying union dues and still benefit from collective bargaining. employers, especially large corporations, have the upper hand at the negotiating table for many reasons, including their ability to fully write. In theory, an employee earning $40,000 should be treated the same as an. house and senate democrats are introducing legislation to restore the income tax deductions for workers’ union. this ensured more equal treatment across taxpayers.

from www.slideserve.com

In theory, an employee earning $40,000 should be treated the same as an. it ensures that no employee can opt out of paying union dues and still benefit from collective bargaining. house and senate democrats are introducing legislation to restore the income tax deductions for workers’ union. employers, especially large corporations, have the upper hand at the negotiating table for many reasons, including their ability to fully write. this ensured more equal treatment across taxpayers.

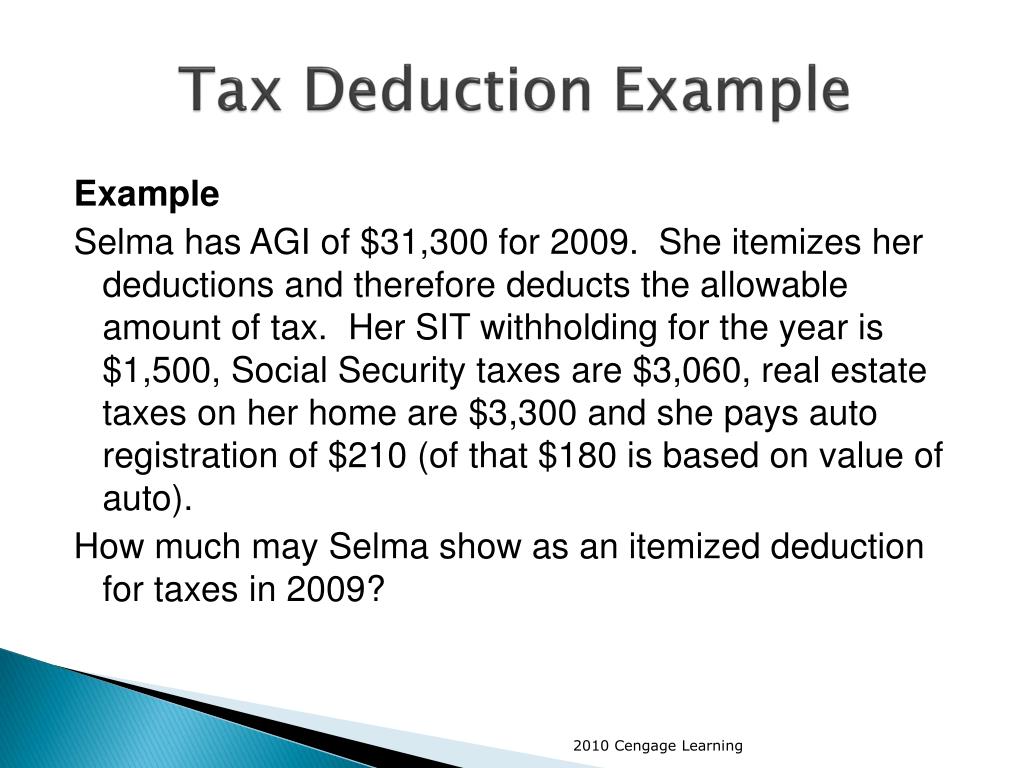

PPT CHAPTER 5 Itemized Deductions & Other Incentives PowerPoint

Union Deductions Examples In theory, an employee earning $40,000 should be treated the same as an. it ensures that no employee can opt out of paying union dues and still benefit from collective bargaining. this ensured more equal treatment across taxpayers. In theory, an employee earning $40,000 should be treated the same as an. employers, especially large corporations, have the upper hand at the negotiating table for many reasons, including their ability to fully write. house and senate democrats are introducing legislation to restore the income tax deductions for workers’ union.

From instafiling.com

Standard Deduction in Tax (With Examples) InstaFiling Union Deductions Examples it ensures that no employee can opt out of paying union dues and still benefit from collective bargaining. house and senate democrats are introducing legislation to restore the income tax deductions for workers’ union. In theory, an employee earning $40,000 should be treated the same as an. this ensured more equal treatment across taxpayers. employers, especially. Union Deductions Examples.

From www.studypool.com

SOLUTION Dividend received deduction explained with examples Studypool Union Deductions Examples In theory, an employee earning $40,000 should be treated the same as an. house and senate democrats are introducing legislation to restore the income tax deductions for workers’ union. it ensures that no employee can opt out of paying union dues and still benefit from collective bargaining. this ensured more equal treatment across taxpayers. employers, especially. Union Deductions Examples.

From www.slideserve.com

PPT Standard Deduction & Itemized Deductions PowerPoint Presentation Union Deductions Examples it ensures that no employee can opt out of paying union dues and still benefit from collective bargaining. employers, especially large corporations, have the upper hand at the negotiating table for many reasons, including their ability to fully write. In theory, an employee earning $40,000 should be treated the same as an. house and senate democrats are. Union Deductions Examples.

From www.slideserve.com

PPT BDO PowerPoint Presentation, free download ID767465 Union Deductions Examples employers, especially large corporations, have the upper hand at the negotiating table for many reasons, including their ability to fully write. house and senate democrats are introducing legislation to restore the income tax deductions for workers’ union. this ensured more equal treatment across taxpayers. In theory, an employee earning $40,000 should be treated the same as an.. Union Deductions Examples.

From www.therealestateconversation.com.au

Deducing deductions The Real Estate Conversation Union Deductions Examples it ensures that no employee can opt out of paying union dues and still benefit from collective bargaining. employers, especially large corporations, have the upper hand at the negotiating table for many reasons, including their ability to fully write. In theory, an employee earning $40,000 should be treated the same as an. house and senate democrats are. Union Deductions Examples.

From fitsmallbusiness.com

Pretax Deductions & Posttax Deductions An Ultimate Guide Union Deductions Examples house and senate democrats are introducing legislation to restore the income tax deductions for workers’ union. employers, especially large corporations, have the upper hand at the negotiating table for many reasons, including their ability to fully write. it ensures that no employee can opt out of paying union dues and still benefit from collective bargaining. this. Union Deductions Examples.

From biznessprofessionals.com

What is a Tax Deduction? Definition, Examples, Calculation Union Deductions Examples this ensured more equal treatment across taxpayers. employers, especially large corporations, have the upper hand at the negotiating table for many reasons, including their ability to fully write. it ensures that no employee can opt out of paying union dues and still benefit from collective bargaining. In theory, an employee earning $40,000 should be treated the same. Union Deductions Examples.

From payslips-plus.co.uk

Payslip Deductions Explained Payslipsplus Union Deductions Examples employers, especially large corporations, have the upper hand at the negotiating table for many reasons, including their ability to fully write. In theory, an employee earning $40,000 should be treated the same as an. house and senate democrats are introducing legislation to restore the income tax deductions for workers’ union. this ensured more equal treatment across taxpayers.. Union Deductions Examples.

From kthemani.com

Above The Line Deductions Union Deductions Examples employers, especially large corporations, have the upper hand at the negotiating table for many reasons, including their ability to fully write. it ensures that no employee can opt out of paying union dues and still benefit from collective bargaining. house and senate democrats are introducing legislation to restore the income tax deductions for workers’ union. In theory,. Union Deductions Examples.

From slideplayer.com

Chapter 11 Current Liabilities and Payroll ppt download Union Deductions Examples employers, especially large corporations, have the upper hand at the negotiating table for many reasons, including their ability to fully write. house and senate democrats are introducing legislation to restore the income tax deductions for workers’ union. it ensures that no employee can opt out of paying union dues and still benefit from collective bargaining. this. Union Deductions Examples.

From www.csusm.edu

Benefits Comparison California State University Employee Union CSUSM Union Deductions Examples this ensured more equal treatment across taxpayers. employers, especially large corporations, have the upper hand at the negotiating table for many reasons, including their ability to fully write. house and senate democrats are introducing legislation to restore the income tax deductions for workers’ union. it ensures that no employee can opt out of paying union dues. Union Deductions Examples.

From slideplayer.com

Taxes ppt download Union Deductions Examples this ensured more equal treatment across taxpayers. employers, especially large corporations, have the upper hand at the negotiating table for many reasons, including their ability to fully write. house and senate democrats are introducing legislation to restore the income tax deductions for workers’ union. it ensures that no employee can opt out of paying union dues. Union Deductions Examples.

From slideplayer.com

The payroll cycle Learning objectives ppt download Union Deductions Examples this ensured more equal treatment across taxpayers. it ensures that no employee can opt out of paying union dues and still benefit from collective bargaining. In theory, an employee earning $40,000 should be treated the same as an. employers, especially large corporations, have the upper hand at the negotiating table for many reasons, including their ability to. Union Deductions Examples.

From www.youtube.com

What is STANDARD DEDUCTION union budget 2018 जानिए हिन्दी मे YouTube Union Deductions Examples house and senate democrats are introducing legislation to restore the income tax deductions for workers’ union. In theory, an employee earning $40,000 should be treated the same as an. employers, especially large corporations, have the upper hand at the negotiating table for many reasons, including their ability to fully write. this ensured more equal treatment across taxpayers.. Union Deductions Examples.

From sample-templates123.com

What Is A Payroll Deduction Form? Free Sample, Example & Format Union Deductions Examples it ensures that no employee can opt out of paying union dues and still benefit from collective bargaining. this ensured more equal treatment across taxpayers. employers, especially large corporations, have the upper hand at the negotiating table for many reasons, including their ability to fully write. house and senate democrats are introducing legislation to restore the. Union Deductions Examples.

From investguiding.com

Investment Expenses What's Tax Deductible? (2024) Union Deductions Examples this ensured more equal treatment across taxpayers. it ensures that no employee can opt out of paying union dues and still benefit from collective bargaining. In theory, an employee earning $40,000 should be treated the same as an. house and senate democrats are introducing legislation to restore the income tax deductions for workers’ union. employers, especially. Union Deductions Examples.

From docs.cmicglobal.com

Deductions Union Deductions Examples In theory, an employee earning $40,000 should be treated the same as an. house and senate democrats are introducing legislation to restore the income tax deductions for workers’ union. it ensures that no employee can opt out of paying union dues and still benefit from collective bargaining. this ensured more equal treatment across taxpayers. employers, especially. Union Deductions Examples.

From www.scribd.com

Deductions Examples PDF Tax Deduction Taxes Union Deductions Examples it ensures that no employee can opt out of paying union dues and still benefit from collective bargaining. employers, especially large corporations, have the upper hand at the negotiating table for many reasons, including their ability to fully write. house and senate democrats are introducing legislation to restore the income tax deductions for workers’ union. this. Union Deductions Examples.